MASTER ADJUSTERS

& CONSULTANTS

Public Insurance Adjusters Serving Florida

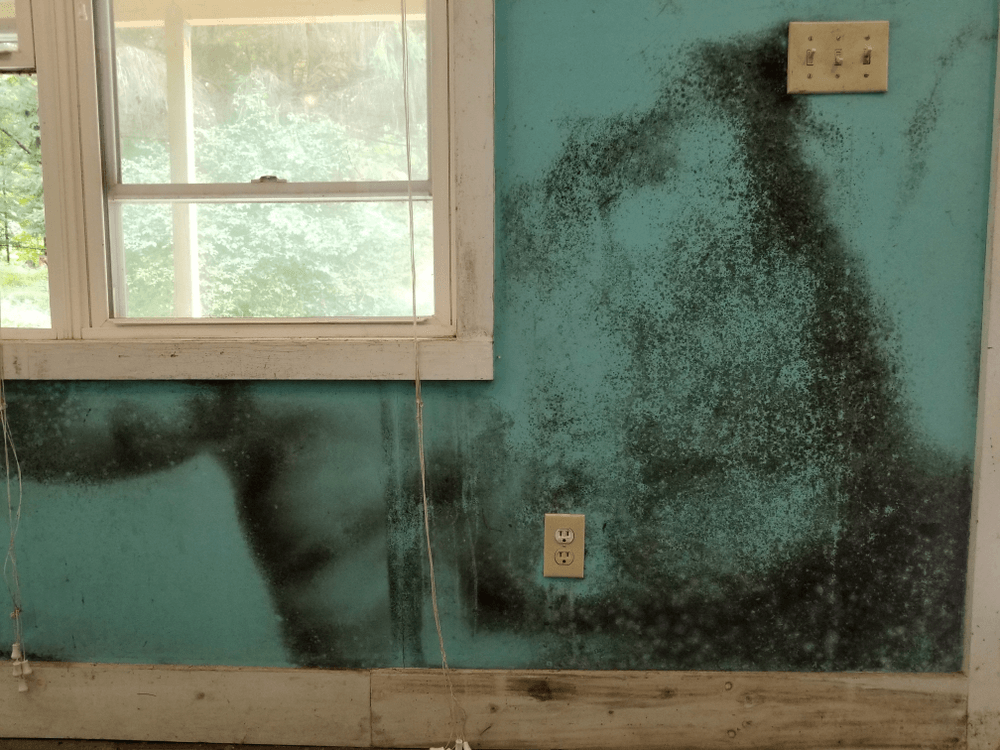

Mold Damage Insurance Claim

Mold Damage

Insurance Claims

In the past, mold damage claims were covered under most property insurance when it resulted from a covered peril, such as a sudden plumbing leak, fire control, storm or other cause covered by your property insurance policy.

Get Started

Get Started

Drop us a line and we’ll get back to you!

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Free Inspection

Free Inspection

Receive a Check

Receive a Check

No Upfront Fees

No Upfront Fees

A Powerful Ally

A Powerful Ally

Mold Damage Insurance ClaimsFrequently Asked Questions:

Mold Damage Insurance Claims

Frequently Asked Questions:

Q: Is my property contaminated by toxic mold?

A: Mold is found in every building. Mold growth is mostly in moist, dark environments conducive to growth. Buildings that have water damage from plumbing leaks or other moisture sources are most susceptible. The current building codes for energy conservation have created environments that lack fresh air supply causing mold to become concentrated in the indoors. The first indications of mold contamination are often illness or development of symptoms by the occupants. If you suspect mold contamination, you should avoid exposure until testing and removal of the mold is completed.

Q: What should I do if my building is contaminated by mold?

A: First, avoid exposure to the contaminated environment. Repeated or continuous exposure may result in serious health problems. You should seek medical attention if you believe the exposure has adversely impacted your health. Next, eliminate the source of moisture in order to mitigate the mold damage, and eliminate the growth source. Remove the mold damaged materials from the building and contents using a certified remediation contractor. Upon completion of the remediation, a qualified industrial hygienist should perform clearance testing to ensure that the levels of mycotoxins are at an acceptable level.

Q: Is the mold damage covered by my insurance?

A: Mold exclusions are now included in most homeowners and commercial property insurance policies. However, covered water losses are typically the main source of mold growth and therefore, your insurance company should be responsible for the cost of the mold abatement provided the building item is damaged by water first. Mold on a water damaged wall, floor or other building items is a sign the item was wet thus water damaged allowing the mold to grow. Some States have approved homeowner’s policy forms that allow you a basic dollar amount for mold remediation in policies and allow you to buy back higher limits.

Q: If it becomes necessary to obtain an expert to assess cause, who pays their fee?

A: In many cases we can present the expert fee in the claim for reimbursement by your insurance company. Either way, the benefits of the experts report far outweighs the cost of the report.

Q: When is the “right time” to hire Master Adjuster & Consultants?

A: Each policyholder must answer this question independently. Retaining a qualified public adjuster early, undoubtedly, can help to avoid “pitfalls” and miscommunication which could lead to a less positive result down the road.

Q: If I turn in a mold/ water claim to my insurance company does this become a permanent record for my property address?

A: Most insurance companies use a central index bureau that records information about an insured and their property when a claim is turned in. For water/mold this is called a “CLUE” report (Comprehensive Loss Underwriting Exchange). If a new insurance company submits an inquiry on your property, old loss information will show up. Thus it is important to have experts provide you with air quality clearance reports once your remediation is complete. You should keep this information in a secure place in the event you need to verify to someone that the work was completed by an expert.

In the past, mold damage claims were covered under most property insurance when it resulted from a covered peril, such as a sudden plumbing leak, fire control, storm or other cause covered by your property insurance policy.

Concerns have increased due to public awareness and scientific knowledge about mold and its health related hazards. The clean-up, removal and remediation techniques are costly and hazardous to the personnel completing them. In response to the public concerns, insurance carriers are removing such coverage from their policy forms regardless if it results from a covered peril. In some instances, the insurance companies offer a limited coverage for mold/fungus for an additional premium.

Qualified Mold Damage Insurance Claims Representatives

Qualified Mold Damage

Insurance Claims Representatives

Mold contamination should be taken very seriously as it can cause severe illness to some people and considerable damage to property. Before the changes to exclude mold coverage from policies the carrier quickly minimized the impact of mold often suggesting a little bleach as a solution. Insurance company representatives often quote the policy exclusions for mold even when coverage may exist for your mold damage. Master Adjusters & Consultants can assess your mold damage claim and advise the necessary course of action.

Mold damages often require testing to identify the remediation protocol for your specific type of mold damage. Once a protocol is prepared, a remediation contractor will follow this document when removing the damage from the building. Upon completion of the remediation, air clearance testing is needed to determine the success of the contractor’s efforts.

After first investigating the loss, your Master Adjusters & Consultants representative will advise you on the most effective and accurate way to assess and document your mold loss including advice on whether the use of outside experts is warranted and necessary.

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Serving All Cities Including:

Doral | Hialeah | Hialeah Gardens | Cutler Bay | Kendall | South Miami | Homestead | Westchester |

Punta Gorda | Lehigh Acres | North Ft Myers | Cape Coral | Port Charlotte